Deep Life Reflections: Friday Five

Issue 17 - Enough

Hello and welcome to my weekly email newsletter, Deep Life Reflections: Friday Five, where I share five things I’m enjoying, thinking about, and find interesting.

If you have a friend, family member, or colleague who you think would also enjoy Deep Life Reflections, simply copy, paste and send them this subscription link:

https://www.deeplifejourney.com/subscribe

Here’s this week’s Friday Five.

1. What I’m Reading

The Psychology of Money. By Morgan Housel.

This is one of the best personal finance books I’ve read. It’s central premise is that doing well with money isn’t about what you know, it’s about how you behave. And behaviour is hard to teach. As Housel explains, investing and personal finance is typically taught around data and formulas. But in the real world, people don’t make their financial decisions on a spreadsheet. They make them at the dinner table or while lounging on the sofa.

Housel writes 20 approachable chapters exploring the strange ways we think about money, and how we can make better sense of one of life’s most important yet misunderstood topics. He makes the compelling case that controlling our time is the highest dividend money pays. Control is freedom and independence.

“The ability to do what you want, when you want, with the people you want, for as long as you want, is priceless.”

One of the best chapters is called ‘Never Enough’. The idea of knowing when you have ‘enough’, and being happy with enough. The danger of more—more money, more power, more prestige—often pushes people into a cycle of envy, regret and unhappiness. A reminder that financial wellbeing, much like happiness, is not about constantly accumulating more, but finding satisfaction in what we already have. The Psychology of Money isn’t just a book about understanding money; it’s about understanding ourselves.

2. What I’m Watching

How to Get Rich. Hosted by Ramit Sethi.

Ramit Sethi is someone who talks a lot of sense. Similar to Morgan Housel, Sethi’s mission is to help individuals gain a clearer understanding of their relationship with money. It’s a shame about the show’s title, ‘How to Get Rich’, because we can misinterpret it. Sethi’s concept of a ‘rich life’ doesn’t infer the relentless pursuit of money. Instead, it’s a subjective term: a ‘rich life’ could mean more time with family, a change in living conditions, financial security, or a career change that aligns better with one’s purpose. It’s more about gaining control in life.

Throughout the series, Sethi explores the dynamics between personal finances, relationships, and overall wellbeing. He guides individuals and couples on a journey to understand and reshape their financial strategies within the broader context of their lives. With some participants, he’s more successful than others, highlighting the difficulty of changing ingrained behaviours.

While How to Get Rich is entertainment—some participants may amuse or even irritate you—it conveys important messages about the role of money in our lives, and especially how our financial habits can impact our relationships and personal wellbeing.

3. What I’m Contemplating

In my Pillars on Deep Life Journey, I include financial wellbeing as part of the ‘Constitution’ pillar, alongside physical and mental wellbeing. The reasoning is simple: financial wellbeing can provide a sense of control, which grants freedom and independence.

But achieving financial wellbeing isn’t easy. Despite money having been around a long time, the art of investing is relatively new to many. In fact, the concept of retirement itself—a significant focus of financial planning—is just a couple of generations old. Before then, people worked until they died.

I’m not sure what is taught at school these days (it’s been three decades since I last sat in a classroom), but being financially literate and learning good financial habits would be a valuable skill to learn at a young age. It’s not something I was taught at school; I had to figure it out myself. And even as adults today, it’s not too late to gain a better understanding. It’s not as complex as the financial world would have you think.

Mastering the psychology of money can be a powerful tool. It not only provides peace of mind, but also allows you to live life fully.

4. A Quote to note

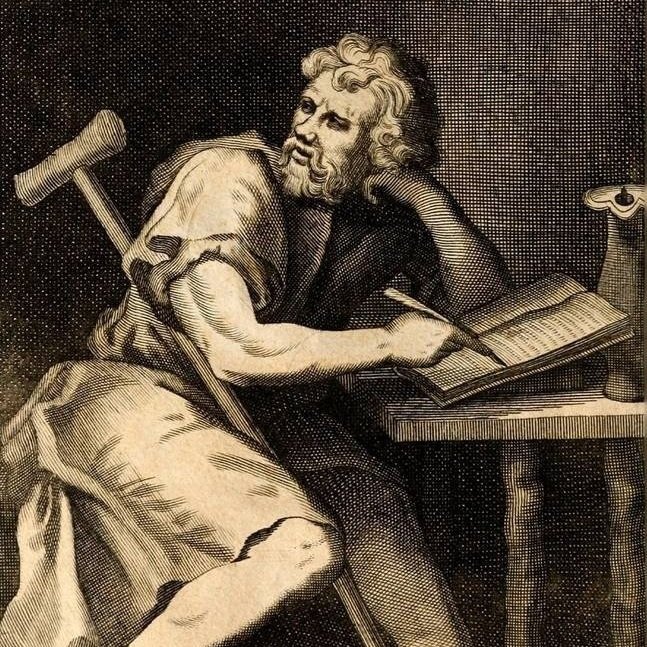

“Wealth consists not in having great possessions, but in having few wants.”

- Epictetus

5. A Question for you

What does financial wellbeing mean to you?

Want to share this issue of Deep Life Reflections via text, social media, or email? Just copy and paste this link:

https://www.deeplifejourney.com/deep-life-reflections/june-16-2023

Don’t forget to check out my website, Deep Life Journey, for full content on my Pillars, Perspectives & Photography.

And you can read all previous issues of Deep Life Reflections here.

Thanks for reading and have a great weekend.

James